In the dynamic world of forex trading, the ability to make informed decisions quickly can be the difference between profit and loss. High-performance forex signals provide traders with timely recommendations that can enhance their trading strategies. This article explores what forex signals are, their benefits, how to choose the best signals, and tips for using them effectively to improve your trading outcomes.

1. Understanding Forex Signals

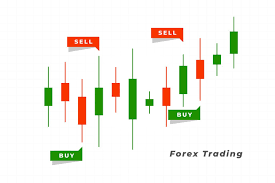

Forex signals are actionable insights that indicate when to buy or sell currency pairs. These signals are derived from comprehensive analysis—technical, fundamental, or both—and provide specific details such as:

v Currency Pair: The specific currencies to be traded (e.g., EUR/USD).

v Action: Whether to buy or sell.

v Entry Price: The suggested price to enter the trade.

v Stop-Loss Level: A price point to limit potential losses.

v Take-Profit Level: The price at which to secure profits.

Traders can receive best forex signals through various channels, including mobile applications, SMS, and email. Understanding how these signals work is essential for leveraging them effectively.

2. Benefits of Using High-Performance Forex Signals

Utilizing high-performance forex signals can offer several advantages to traders, regardless of their experience level:

A. Time Efficiency

Trading in the forex market requires constant monitoring of multiple currency pairs and economic news. High-performance forex signals save time by providing ready-to-use recommendations, allowing traders to focus on executing trades rather than conducting analysis.

B. Improved Accuracy

High-performance forex signals are often based on robust analytical methods. By following expert recommendations, traders can increase their chances of making profitable trades. Signals generated by experienced traders or sophisticated algorithms tend to be more reliable.

C. Risk Management

Effective risk management is crucial in forex trading. High-quality signals usually come with stop-loss and take-profit recommendations, helping traders manage their risk exposure. This structured approach minimizes potential losses and locks in profits.

D. Educational Value

For novice traders, following forex signals can serve as a learning tool. Analyzing the reasons behind the signals can deepen their understanding of market dynamics, technical indicators, and trading strategies.

3. Choosing the Right Forex Signals Provider

Selecting a reliable forex signals provider is critical for maximizing the benefits of trading signals. Here are some key factors to consider:

A. Track Record and Performance

Investigate the provider’s historical performance:

Win Rate: Look for a high percentage of successful trades (ideally above 70%).

Transparency: Ensure that the provider shares past performance data openly, allowing you to verify their claims.

B. Reputation

Research the provider’s reputation by:

Reading Reviews: Check online reviews and testimonials from current or past users.

Engaging with the Community: Participate in trading forums or groups to gather insights about the provider’s reliability.

C. Analysis Methodology

Assess how signals are generated:

Technical Analysis: Providers should utilize various technical indicators and chart patterns.

Fundamental Analysis: Check if the provider considers economic news and geopolitical events in their analysis.

Algorithmic Trading: Some providers may use automated systems; ensure these systems are based on sound algorithms.

D. Delivery Methods

Timely delivery of signals is crucial. Consider:

Notification Channels: Ensure the provider offers alerts via multiple channels (SMS, email, app notifications).

Real-Time Updates: Signals should be updated in real-time to reflect market changes.

4. How to Effectively Use Forex Signals

Once you’ve chosen a reliable forex signals provider, it’s essential to integrate the signals into your trading strategy effectively. Here are some tips for using forex signals wisely:

A. Use Signals as a Supplement

Treat forex signals as a tool to enhance your existing trading strategy rather than a replacement. Combine signals with your market analysis to improve your decision-making process.

B. Practice with a Demo Account

Before trading with real capital, practice using forex signals on a demo account. This helps you become familiar with how to enter trades based on signals without risking your funds.

C. Maintain a Trading Journal

Keep a record of all trades based on signals, noting entry and exit points, profits, and losses. Analyzing this data can help you identify patterns and refine your trading strategy over time.

D. Manage Your Risk

Always implement risk management techniques when following signals. Use stop-loss orders to protect your capital, and never risk more than a small percentage of your trading account on a single trade.

E. Stay Informed About Market Conditions

While signals provide valuable insights, staying updated on market news and economic events is essential. Major news releases can impact currency prices significantly, so being informed can help you anticipate market movements.

5. Common Pitfalls to Avoid

When using forex signals, it’s crucial to avoid common pitfalls that could jeopardize your trading success:

A. Blindly Following Signals

While forex signals can provide valuable insights, relying on them without understanding the rationale behind them can lead to mistakes. Always analyze the signals and the underlying market conditions.

B. Ignoring Risk Management

Failing to implement effective risk management can result in substantial losses. Always use stop-loss orders and be mindful of the percentage of your trading capital you risk on each trade.

C. Overtrading

Following too many signals simultaneously can lead to overtrading and increased transaction costs. Focus on high-quality signals that align with your trading strategy.

D. Lack of Continuous Learning

The forex market is dynamic, and strategies need to evolve. Stay committed to continuous learning by reviewing your trades, understanding market trends, and improving your trading skills.

6. Conclusion

High-performance forex signals are invaluable tools for traders looking to enhance their trading strategies. By understanding what forex signals are, recognizing their benefits, choosing the right provider, and using them effectively, traders can significantly improve their chances of success in the forex market.

Incorporating high-quality forex signals into your trading routine allows for smarter decision-making, effective risk management, and continuous learning. Remember, successful trading is a combination of using the right tools, staying informed, and continually refining your skills. By embracing high-performance forex signals, you can navigate the complexities of the forex market and move closer to achieving your trading goals.