In today’s fast-paced digital world, managing your finances should be straightforward and efficient. N26, a trailblazing digital bank, offers a comprehensive online platform that revolutionizes how you handle your money. With N26 Login, you gain access to a wealth of tools designed to enhance convenience, security, and control over your financial activities. This article will explore the standout features of N26 Login, its benefits, and how to effectively utilize it to streamline your banking experience.

Introduction to N26

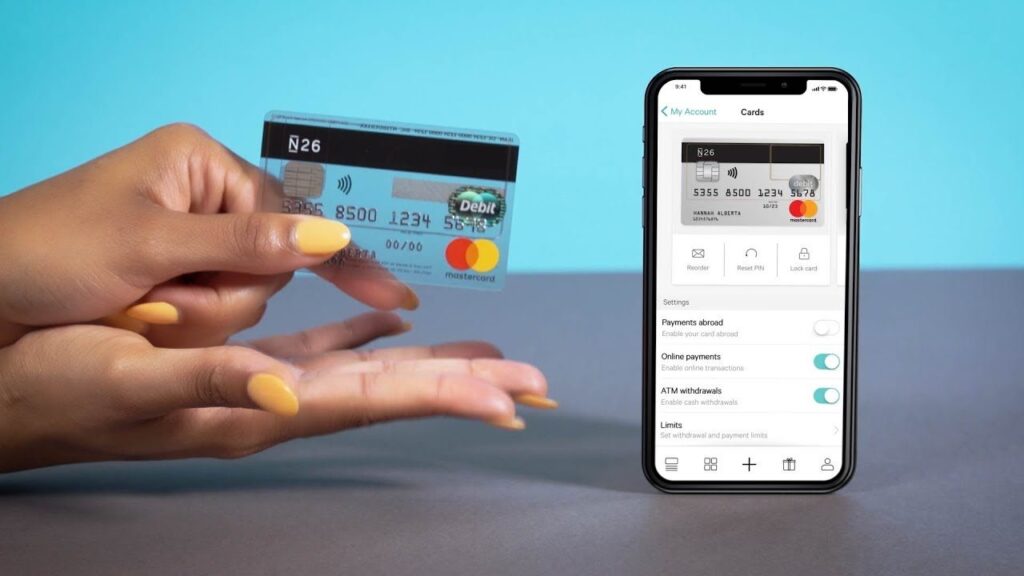

N26 is a Berlin-based digital bank established in 2013. It has rapidly expanded, now serving millions of customers across Europe and the United States. Known for its innovative approach and user-centric design, N26 offers a modern banking experience that emphasizes simplicity and transparency.

The Advantages of N26 Login

The N26 Login provides seamless access to your financial world. Here’s how it empowers you:

Customized User Experience

When you log into N26, you’re greeted with a personalized dashboard. This feature allows you to set up shortcuts and widgets tailored to your most-used functions, such as viewing balances, transaction histories, and upcoming payments. This customization makes your banking experience more intuitive and efficient.

Advanced Security Features

Security is paramount at N26. The platform employs cutting-edge encryption, two-factor authentication, and biometric login options (such as fingerprint or facial recognition) to ensure your data remains secure. Additionally, N26 continuously monitors your account for any unusual activity, providing peace of mind.

Universal Accessibility

N26 Login offers global accessibility, ensuring you can manage your finances anywhere, anytime. Whether you’re at home, traveling, or at work, you can effortlessly access your account and perform transactions without geographical constraints.

Instant Account Notifications

Stay on top of your financial activities with real-time notifications. N26 alerts you instantly about deposits, withdrawals, and payments, keeping you informed and in control of your finances.

Navigating N26 Login

Step 1: Access the N26 Platform

Begin by visiting the official N26 website or downloading the N26 mobile app. The login option is prominently displayed on the homepage or the app’s main screen.

Step 2: Enter Your Login Details

Input your registered email address and password. For new users, follow the sign-up process, which includes providing personal details and setting up security preferences.

Step 3: Secure Your Account

Complete the security verification process. This may involve entering a code sent to your phone or using biometric authentication if enabled. This step ensures your account remains secure.

Step 4: Explore Your Dashboard

Once logged in, you’ll have access to your personalized dashboard. Here, you can view account balances, recent transactions, and navigate through various features like fund transfers and bill payments.

Key Features of N26 Login

Comprehensive Account Management

N26 Login offers a detailed overview of all your accounts. You can monitor spending, track income, and get insights into your financial habits, all from one place.

Quick and Easy Money Transfers

Sending money with N26 is swift and hassle-free. You can transfer funds domestically or internationally with competitive exchange rates and low fees. The process is designed to be straightforward, ensuring your money reaches its destination promptly.

Efficient Bill Payments

Paying bills is effortless with N26’s integrated bill payment system. Schedule payments, set up recurring transactions, and receive reminders to avoid missing due dates. This feature helps you manage your expenses seamlessly.

Savings and Budgeting Tools

N26 offers robust tools to help you save and budget effectively. Create sub-accounts for different savings goals, automate transfers, and monitor your progress. These tools make it easy to manage and achieve your financial objectives.

In-Depth Financial Insights

Gain valuable insights into your spending patterns and financial behavior with N26’s analytics tools. The platform categorizes your expenses, highlights trends, and provides personalized tips to enhance your financial health.

Benefits of Using N26 Login

Round-the-Clock Access

N26 ensures you can manage your finances anytime, anywhere. This 24/7 accessibility is crucial for keeping up with your financial commitments, no matter where you are or what time it is.

Top-Tier Security

With N26, your financial security is a priority. The platform’s advanced security features protect your data and transactions, giving you confidence and peace of mind.

Speed and Efficiency

N26’s digital-first approach ensures that transactions are processed quickly and efficiently. Whether you’re transferring money, paying bills, or accessing funds, the platform’s speed ensures timely completion of all your financial activities.

User-Friendly Interface

The intuitive design of N26 makes it accessible for users of all tech levels. The platform’s simplicity allows you to perform banking tasks with ease, reducing the learning curve associated with new technologies.

Comprehensive Financial Solutions

From saving and spending to investing and budgeting, N26 provides a one-stop solution for all your financial needs. This comprehensive approach simplifies managing your money and achieving your financial goals.

Frequently Asked Questions About N26 Login

How Secure is N26 Login?

N26 employs advanced encryption, multi-factor authentication, and continuous monitoring to ensure the security of your account. These measures protect against unauthorized access and fraud.

Can I Access N26 from Multiple Devices?

Yes, you can access N26 from any device with internet connectivity. The platform supports both desktop and mobile access, ensuring flexibility in how you manage your finances.

What If I Forget My Login Details?

If you forget your email or password, N26 offers a straightforward recovery process. Follow the prompts on the login page to reset your credentials and regain access to your account.

Are There Fees for Using N26?

N26 offers a range of account types, including free options. Some premium features and international transfers may incur fees. It’s best to review the fee schedule on the N26 website for detailed information.

How Do I Contact N26 Support?

N26 provides customer support through various channels, including live chat, email, and phone. Access the support section on the website or app for assistance with any issues or questions.

Tips for Maximizing Your N26 Experience

Regularly Update Your Security Settings

Ensure your security settings are up-to-date. Enable biometric login options and review your multi-factor authentication preferences regularly to maintain optimal account security.

Utilize Budgeting Tools

Take advantage of N26’s budgeting tools to track your spending and savings goals. Regularly review your financial analytics to identify areas where you can improve your financial health.

Set Up Alerts

Configure alerts for account activities such as large transactions, low balances, and bill payments. These alerts help you stay informed and avoid potential issues with your account.

Explore All Features

Spend time exploring all the features N26 offers. From savings Spaces to financial insights, utilizing the full range of tools can help you manage your finances more effectively.

Contact Support When Needed

Don’t hesitate to reach out to N26 support if you encounter any issues or have questions about your account. The support team is there to help you make the most of your banking experience.

Conclusion

N26 Login provides a secure, efficient, and user-friendly platform for managing your finances. With its advanced features and comprehensive tools, N26 makes digital banking easy and accessible. Whether you’re checking your balance, transferring funds, or paying bills, N26 Login offers everything you need to take control of your financial future. Experience the convenience and reliability of N26 today and discover how it can transform your banking experience.